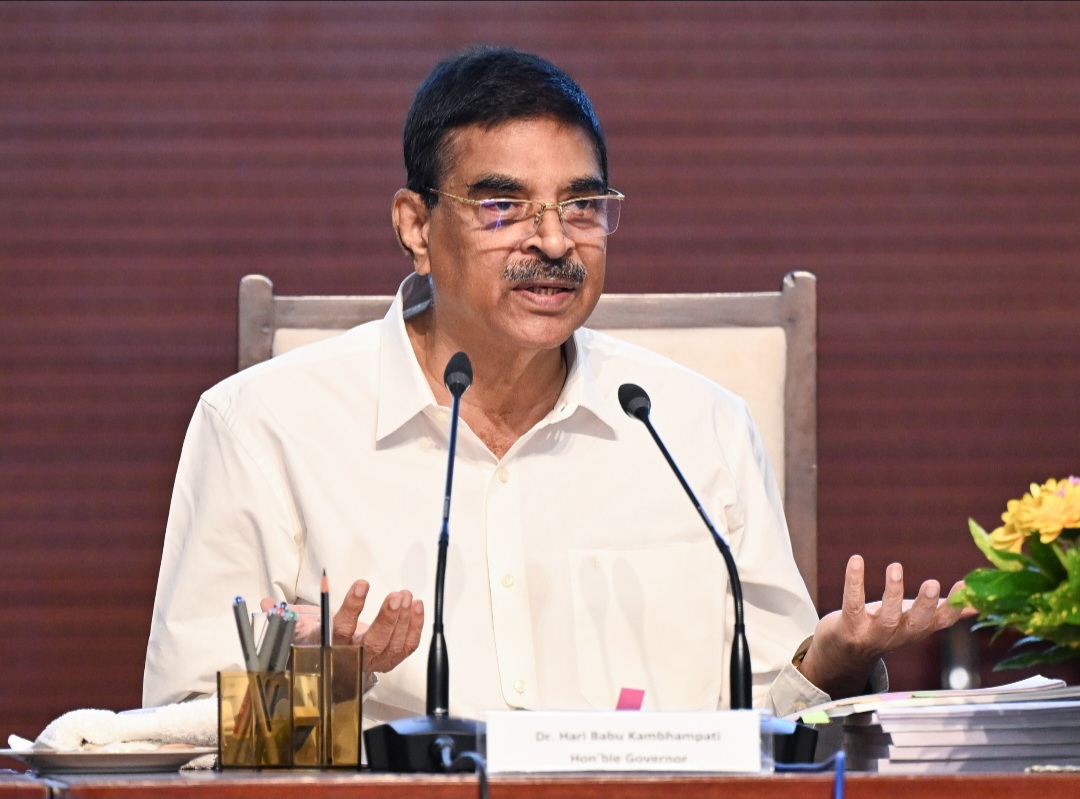

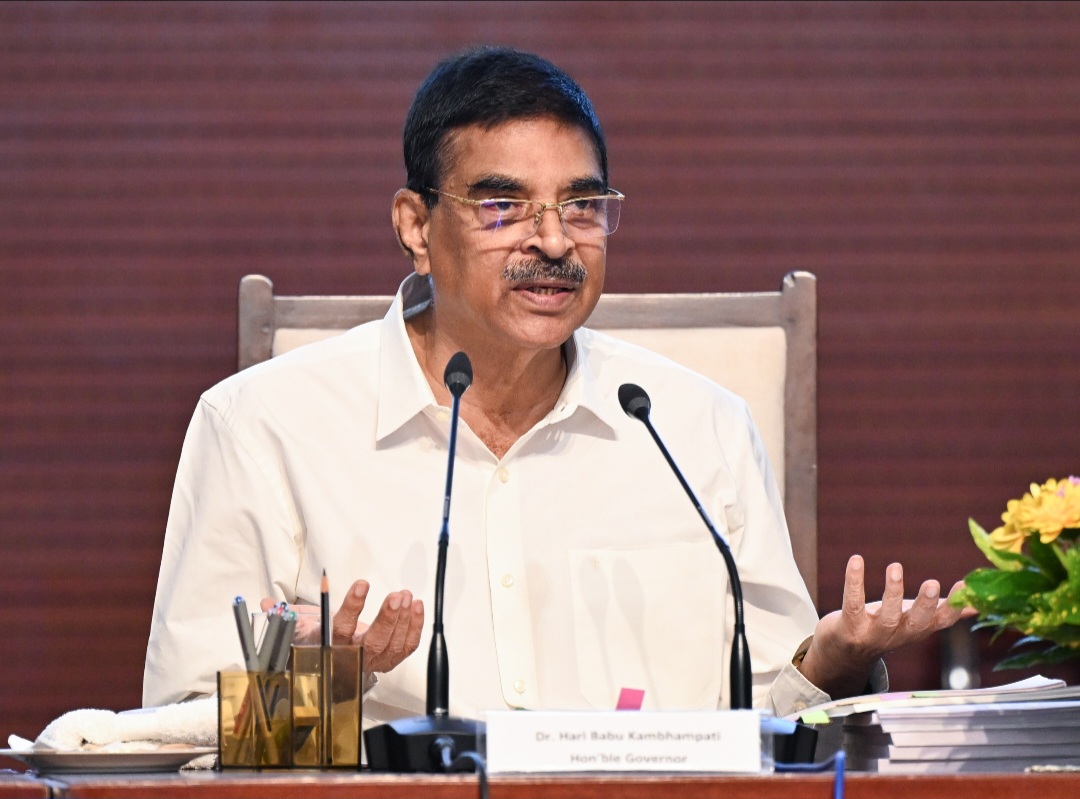

Odisha Governor urges bankers to adopt humane approach, ensure wider coverage of welfare schemes

Bhubaneswar(18/10/2025): Odisha Governor Dr Hari Babu Kambhampati on Saturday called upon bankers to adopt a more humane and empathetic approach while dealing with benrficiaries and to actively promote pro-people schemes aimed at improving livelihoods. Speaking at a Ideation Workshop on the Issues, Challenges, and Achievements of Bank-Linked Livelihood Scheme at the New Abhishek Hall in Raj Bhavan, Bhubaneswar, the Governor said, "Bankers should not merely focus on transactions but understand the social impact of government welfare initiatives.The state’s growth rate stands at 7% and the target is to reach 9%.In achieving this, the role of bankers is pivotal.They are key drivers in building a Viksit Odisha." Expressing concern over the low enrollment of people under welfare schemes like the Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), the Governor said many bankers fail to establish personal connections with customers or explain the benefits of such schemes He urged banks to aim for universal coverage and ensure that at least 80% of savings account holders are enrolled in these schemes.The Governor suggested that banks send postcards to customers explaining the benefits of government schemes and check how many clients remain uncovered. Highlighting the need to promote education loans, Dr Kambhampati referred to the Pradhan Mantri Vidya Lakshmi (PM-Vidya Lakshmi) Scheme, stressing that banks should provide loans to all students admitted to national-level institutions without unnecessary hurdles. On the Pradhan Mantri Mudra Yojana (PMMY), the Governor noted that banks often prefer experienced borrowers over fresh entrepreneurs.“Any individual undertaking an economic activity is eligible for a Mudra loan.By financing a new applicant, you are not only supporting a family but also creating employment opportunities for others,” he said. Addressing issues related to housing loans, Dr Kambhampati called for regular dialogue between banks and apartment builders to resolve operational challenges. Referring to the Mukhya Mantri Kamadhenu Yojana, the Governor said some farmers face difficulties in contributing their share of funds to avail subsidies.Linking them with PMMY could help them access loans to start or expand their ventures, he suggested, while emphasizing that 100% of eligible applicants should receive financial support. The Governor also reviewed implementation of the PM SVANidhi Scheme and advised bankers to proactively approach street vendors to ensure they benefit from the programme.“By not extending loans under PM SVANidhi, we leave them at the mercy of moneylenders who charge exorbitant interest,” he said. He also discussed financial support under the Mukhya Mantri Krushi Udyog Yojana, Pradhan Mantri Matsya Sampada Yojana, Prime Minister’s Employment Generation Programme (PMEGP), Stand-Up India, PM Surya Ghar, and Pradhan Mantri Awas Yojana (PMAY), among others. Heads of major banks operating in the state participated in the meeting.The meeting was attended by Deputy Chief Minister Kanak Vardhan Singh Deo; Jagatsinghpur MP Bibhu Prasad Tarai; Development Commissioner-cum-Additional Chief Secretary Anu Garg; Principal Secretary, Fisheries and ARD Department, Suresh Kumar Vashishth; Principal Secretary, Agriculture and Farmers’ Empowerment Department, Arabinda Kumar Padhee; Principal Secretary, Housing and Urban Development Department, Usha Padhee; Principal Secretary, Finance Department, Sanjeeb Kumar Mishra; Principal Secretary, Energy Department, Vishal Kumar Dev; Commissioner-cum- Secreatary to Governor, Roopa Roshan Sahoo; Convener, State Level Bankers’ Committee (SLBC), Gautam Patra; and Regional Director, Reserve Bank of India, Sarada Prasad Mohanty .

Trending

Odisha Governor urges bankers to adopt humane approach, ensure wider coverage of welfare schemes

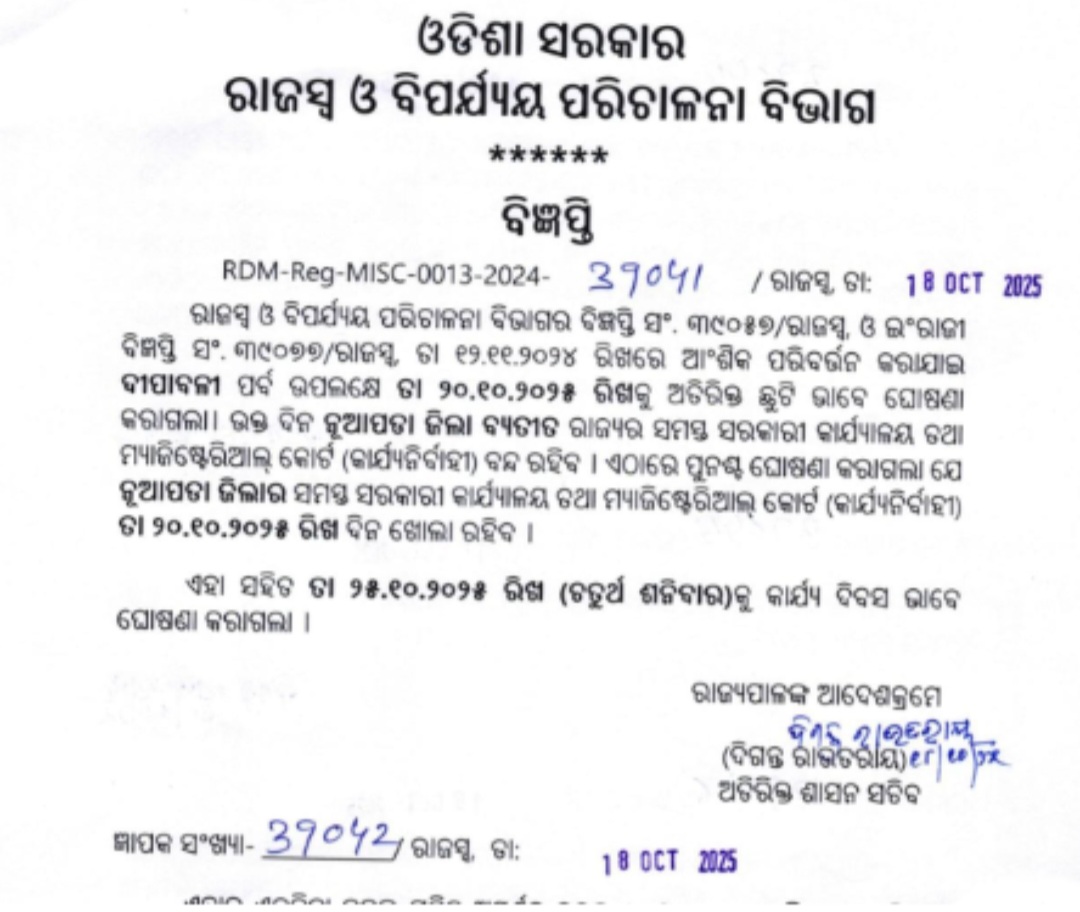

School holiday on Monday

Diwali holiday on October 20, 21

Odisha honoured as Best Performing State under Aadi Karmayogi Abhiyan; Keonjhar recognised as Best District under Dharati Aaba Janbhagidari Abhiyan

Odisha Police launches incentive scheme offering cash rewards for capturing Maoists